40+ how big of a mortgage can i qualify for

Web The amount of a mortgage you can afford based on your salary often comes down to a rule of thumb. Web Now you have your debt ratios.

The Income Required To Qualify For A Mortgage The New York Times

Web The amount of money you spend upfront to purchase a home.

. Web From 75 to 90 the interest rate offered by the bank will increase. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Web You can borrow a minimum of 5 and a maximum of 20 of the propertys full price.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Ad Talk to a Loan Officer about Home Mortgage Refinancing Cash Out or Bill Consolidation. Web The rule of thumb is that you can afford a mortgage where your monthly housing costs are no more than 32 of your gross household income and where your total debt load.

With a Low Down Payment Option You Could Buy Your Own Home. Web That means if you have your eye on a 200000 house youll need at least 10000 to qualify for a mortgage for that home. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Web How much do I need to make to afford a 500000 home. Get Instantly Matched With Your Ideal Mortgage Lender. Ad Calculate Your Payment with 0 Down.

Ad Compare Find the 10 Best Pre Approval Mortgage In US. And how much can I qualify for with my current income. Web If youd put 10 down on a 333333 home your mortgage would be about 300000.

A 20 down payment is ideal to lower your monthly. Apply Easily Save. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Web A 40-year mortgage means that if you made all payments as scheduled without making extra or bigger payments toward the principal to pay it off sooner it would. In that case NerdWallet recommends an annual pretax income of at least 110820. Compare Now Find The Lowest Rate.

Ad Compare More Than Just Rates. Ad Use Our Comparison Site Find Out How to Get Mortgage Pre Qualification In Minutes. For example some experts say you should spend no more than.

Were able to do this by not only considering the loan amount. Ad Tired of Renting. Generally it should be no more than 28 percent of your gross monthly income for the front ratio and 36 percent for the back but the guidelines.

Compare Now Find The Lowest Rate. Web Adding a co-borrower who also makes 50000 per year increases that ceiling so you can better afford a larger loan. On the other hand FHA mortgages.

Get Instantly Matched With Your Ideal Mortgage Lender. Find A Lender That Offers Great Service. With a Low Down Payment Option You Could Buy Your Own Home.

See how much house you can afford. Web For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly. Compare Lenders And Find Out Which One Suits You Best.

An LTV of more than 90 will not qualify for a normal mortgage but will some form of mortgage insurance. Why Rent When You Could Own. As a requirement you must make a 5 deposit and obtain a mortgage to shoulder.

Most home loans require a down payment of at least 3. Ad Use Our Comparison Site Find Out How to Get Mortgage Pre Qualification In Minutes.

We Re Thankful For Our Newest Hires Goprime

Amex Platinum Card Review 80 000 Point Bonus New Perks And Credits

How The World Is Dealing With 40 Zb Data Big Data

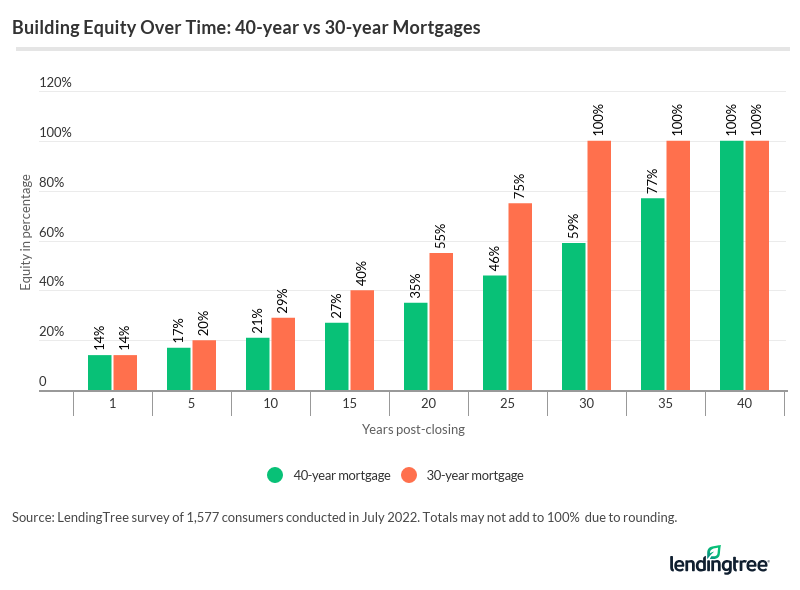

What Is A 40 Year Mortgage Lendingtree

25 Best Loan Service Near North Ridgeville Ohio Facebook Last Updated Feb 2023

1602 40th Street Galveston Tx 77550 Zerodown

19483 County 40 Park Rapids Mn 56470 Realtor Com

Home Alpha Mortgage Corporation

New Mortgage Lending Rules For Canadians Jennifer Gale Real Estate

Mortgage Broker Toronto Mortgage Scout Inc

F0vzs28ojc7elm

How To Raise Your Afterpay Limit All You Need To Know

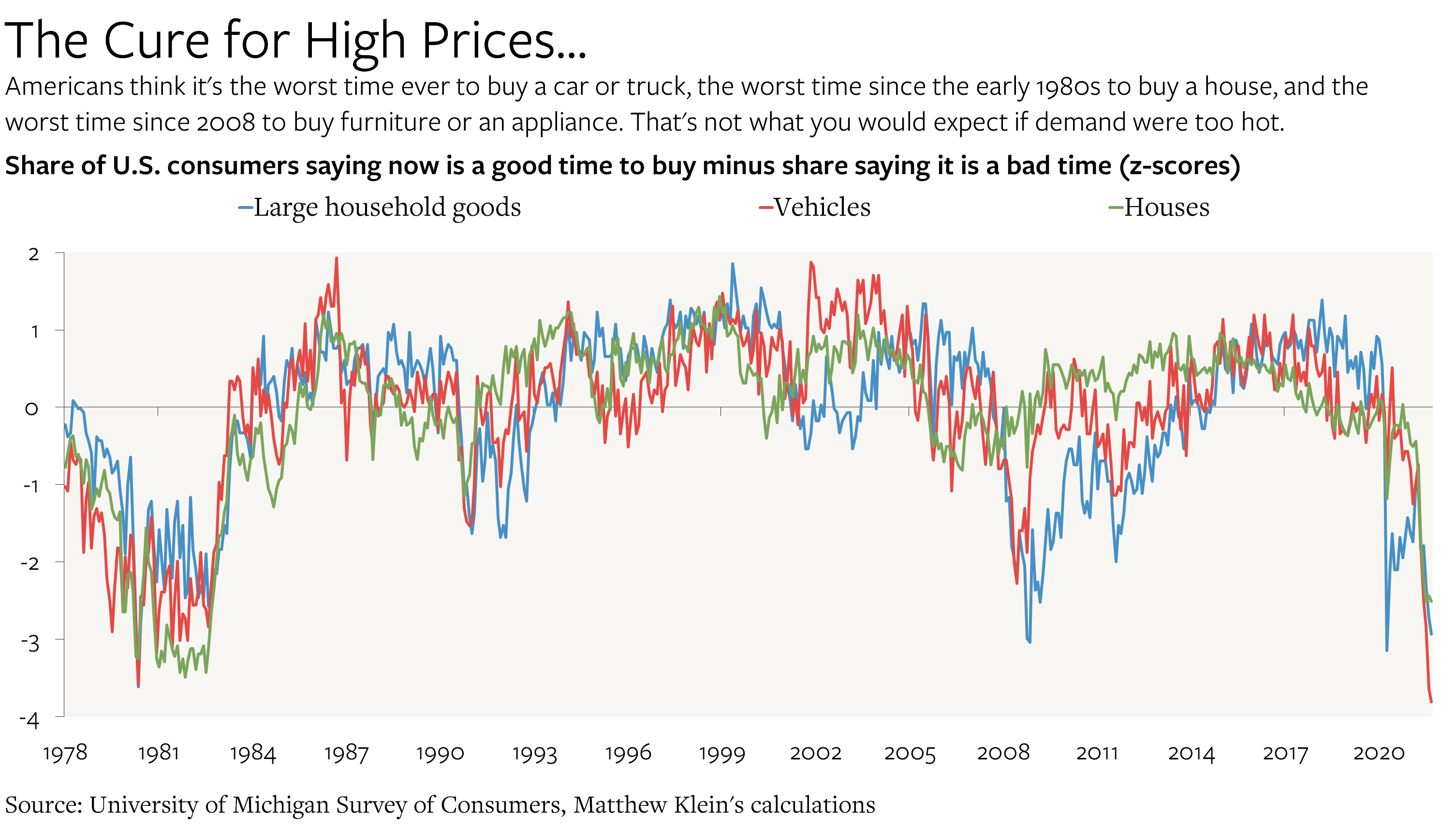

The Case For Patience On Inflation By Matthew C Klein

Mortgage Interest Deduction Homeowners Biggest Tax Perk Hgtv

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

How Much Can I Borrow Mortgage Calculator Which

Mortgage Calculator How Much Can I Borrow Nerdwallet